real estate sub asset classes

The three most common asset classes. Has worked in conjunction with Sterling Management Corp on many properties.

We are currently managing office industrial retail and multifamily properties.

. Each real estate asset class has its pros and cons. MRH Real Estate Services Inc. Kresnak added that many sub-asset classes that stand to gain in a rising real rate environment have been out of favor for years.

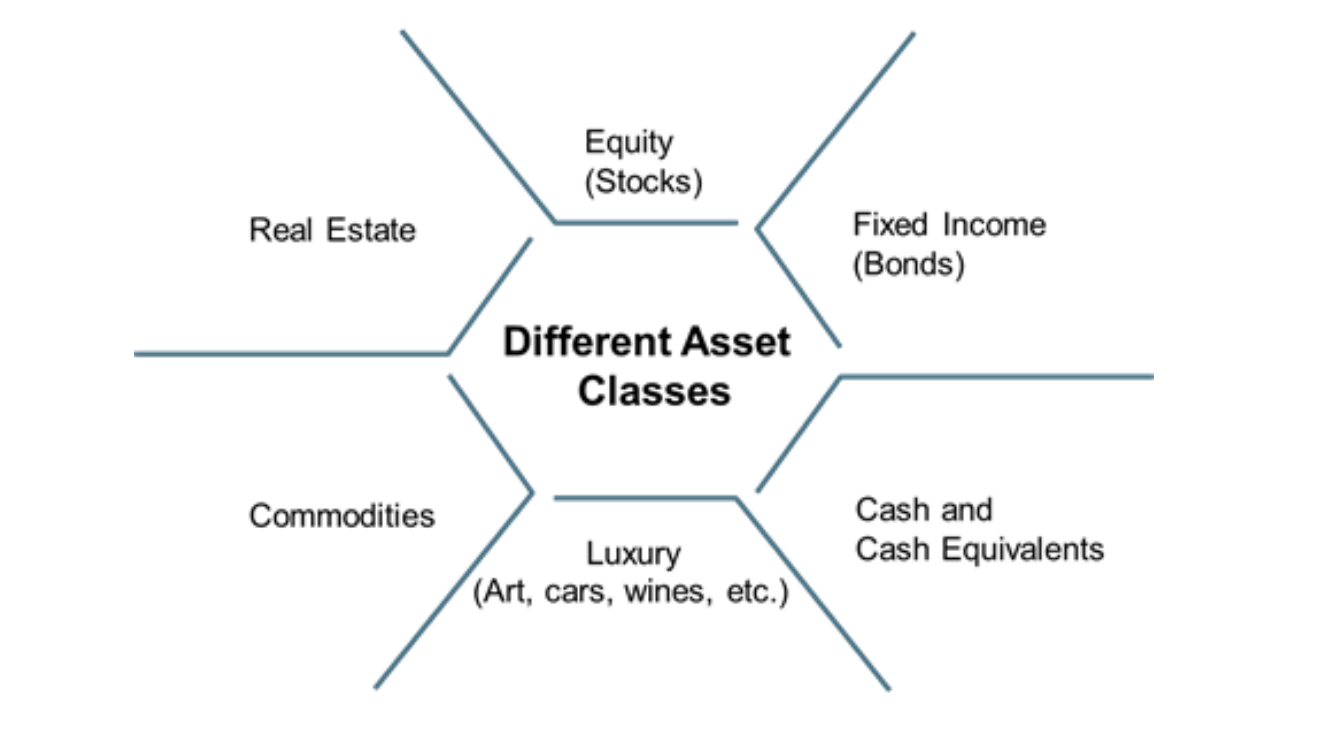

Additionally two common alternative asset classes are. Property types are mistakenly referred to as asset classes by many within the real estate industry. There are actually five main types of assets.

A real estate lender can be protected. Welcome to Standard Holdings Management LLC. Real assets provide storage of value over the long term inflation sensitivity and diversification within a portfolio see Figure 1.

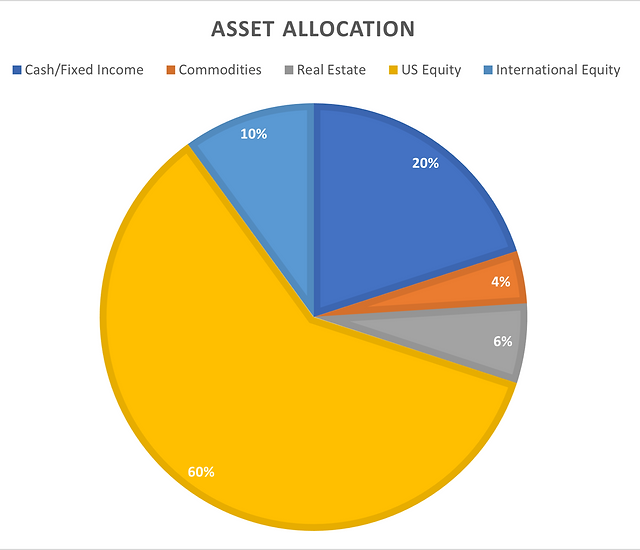

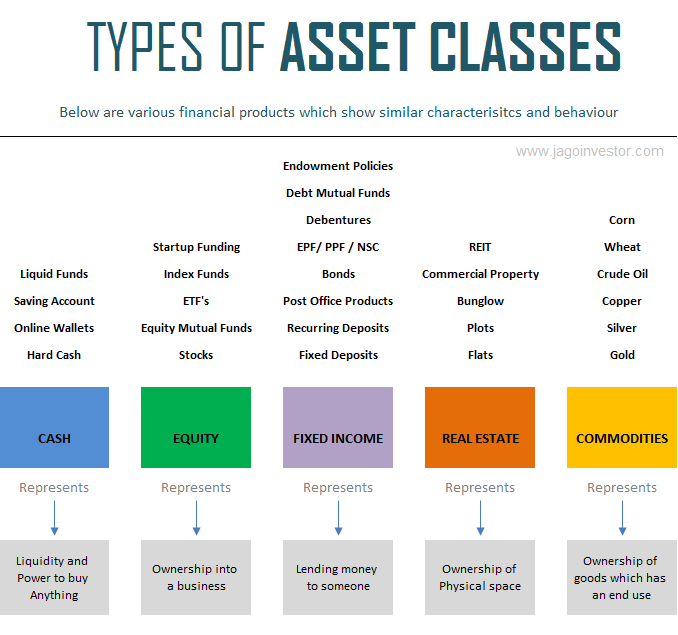

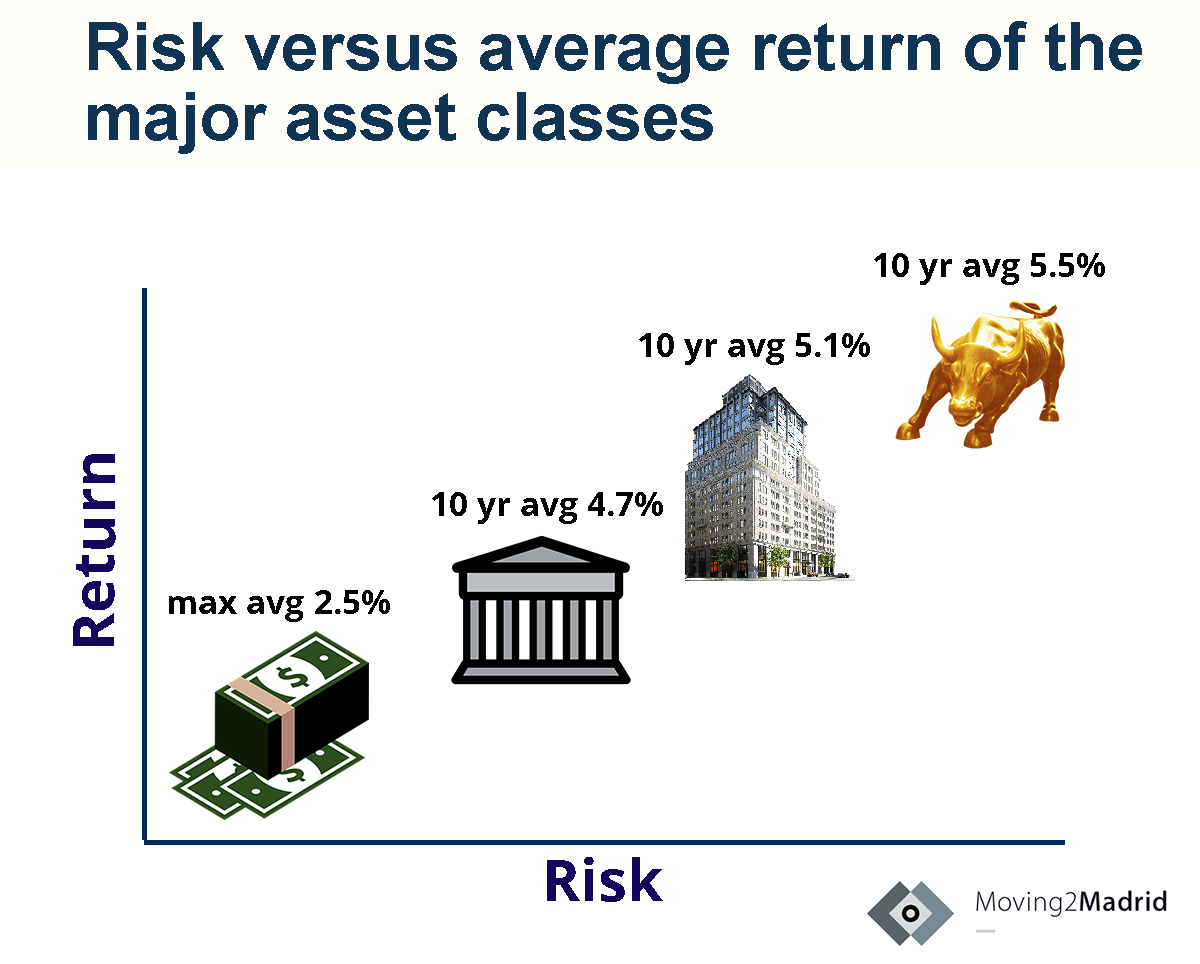

Three traditional asset classes are equities or stocks cash equivalents or a Money Market and fixed income or bonds. Asset Class 2 Equity The equity asset class is an interesting asset class and slowly getting more and more acceptance from the last 1-2 decades. We offer 90-hr Broker Course 30-hr Broker Ethics Course 30-hr Broker.

In addition they tend to have a cash-flow-generating focus. Although Class D properties arent best for investors Class A B and C properties are all solid options depending on your. Residential office industrial retail and hospitality.

As real rates increase the risks are that active. SHM is a unique niche special servicer nationwide loss mitigation fulfillment center and default solution services platform. The commercial real estate market is divided into six primary asset classes.

In general people tend to group. Commercial real estate is generally divvied up into the four basic food groups of office industrial retail and multifamily. We offer a Pre-license Salesperson class that will allow you to get your real estate license in as little as 2 weeks.

Tenants right to sell or sub-lease. Within each asset class properties will be. An asset class is a group of similar investments that react similarly to the markets events and must follow the same rules and regulations.

Real Estate Pre-Licensing Sales-Person Broker Broker-Salesperson and Licensed Real Estate Associates Continuing Education Real Estate CE Credit classes. Call us at 732-650. Equities Fixed Interest Cash.

Real estate investing involves the purchase management and sale or rental of real estate for profit. The tree major traditional asset classes are equities stocks fixed income bonds and cash. Each asset class can be further divided into multiple.

Examples of other asset classes include real estate commodities private equity art or.

Different Asset Classes Part I By Les Nemethy And Sergey Glekov Europhoenix

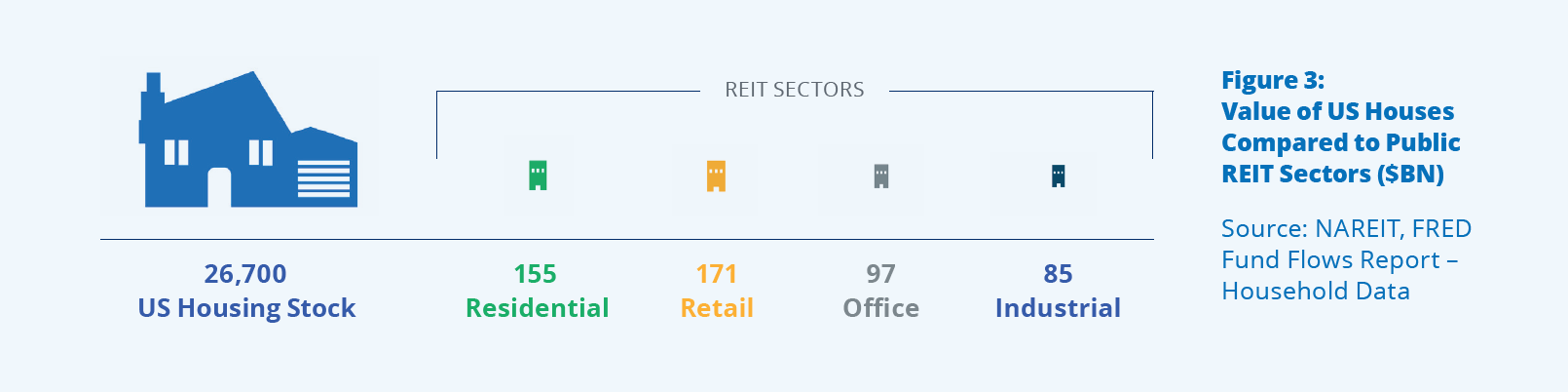

Understanding Real Estate As An Investment Class Mckinsey

Alternatives Investing Across The Spectrum Pensions Investments

Commercial Real Estate Trends Toptal

Real Estate Vs Stocks Other Assets Equitymultiple

Real Assets Pensions Investments

The Stagflation Scenario Defining It And Adapting Asset Allocations Ab

A Guide To Real Estate Asset Classes Property Types And Property Classes

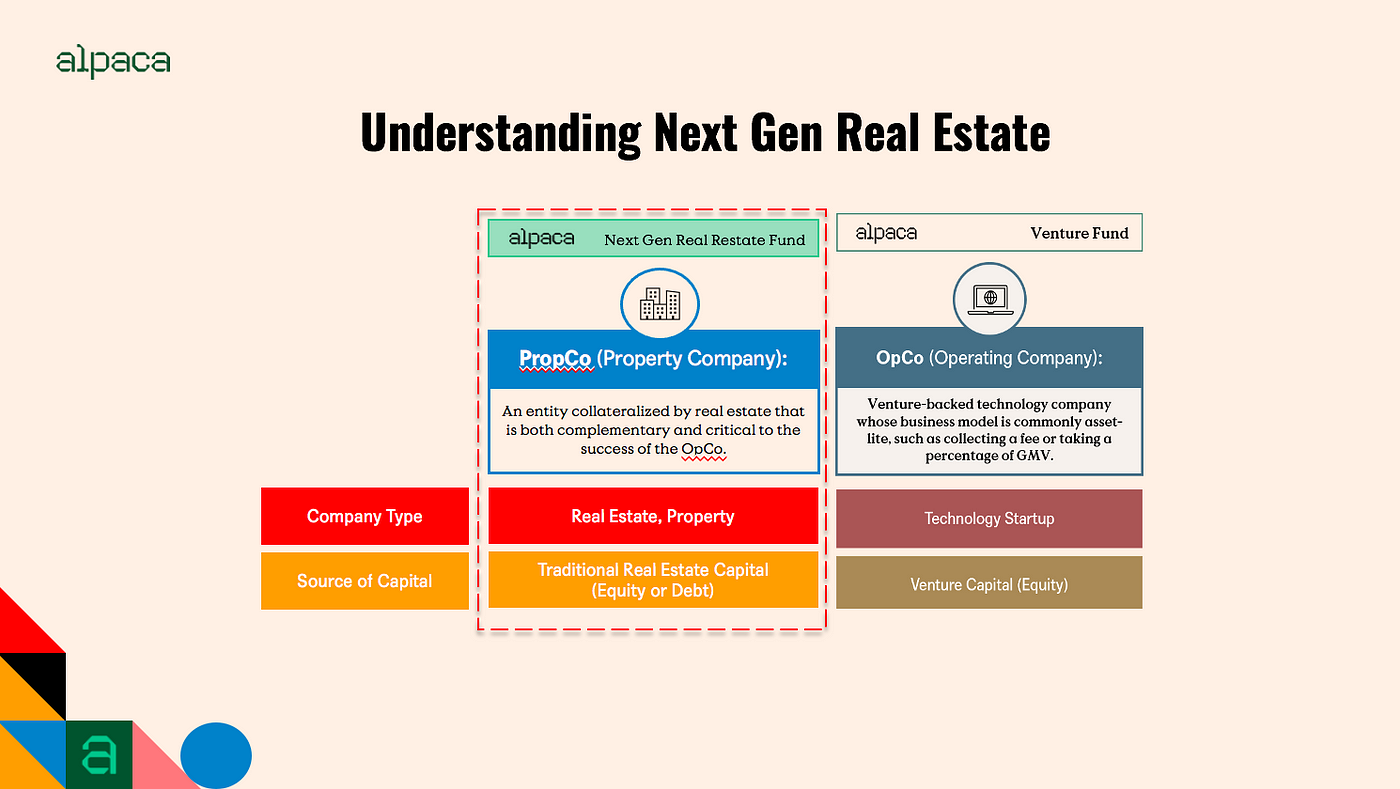

Next Gen Real Estate Yesterday S Real Estate Vs Tomorrow S By Ryan Freedman Alpaca Vc Sep 2022 Medium

5 Asset Classes Explained Guide For Beginner Investors

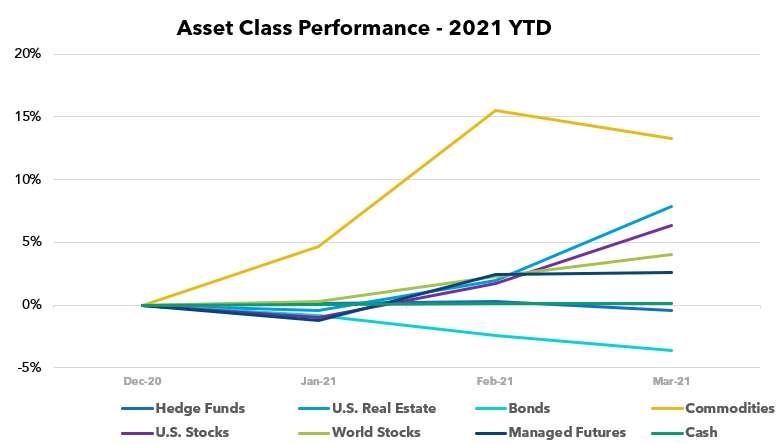

Asset Class Scoreboard March 2021 Seeking Alpha

/most-important-factors-investing-real-estate.asp-ADD-FINALjpg-32950329a30d4500b6d7e0fd0ba95189.jpg)

The Most Important Factors For Real Estate Investing

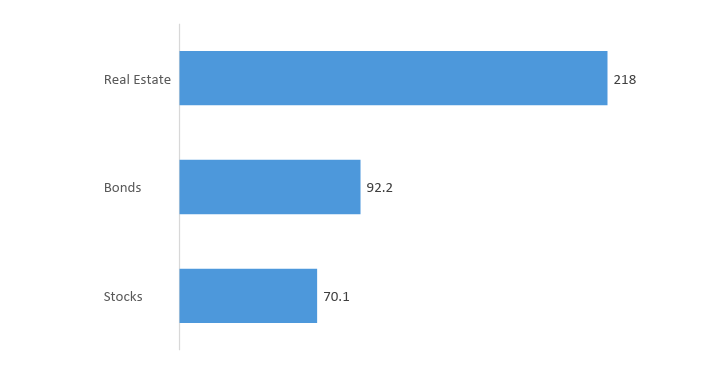

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

Real Estate Or Stocks Which Is A Better Investment

How To Invest In Real Estate The Motley Fool

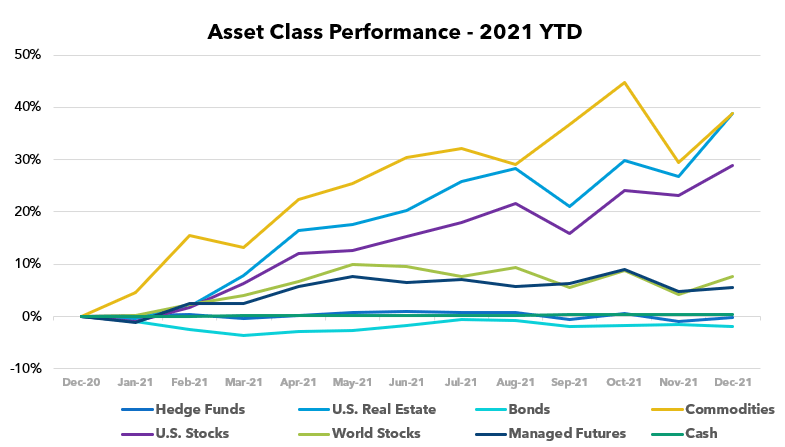

Asset Class Scoreboard December 2021 Seeking Alpha

The Benefits Of Investing In Real Estate Vs Other Assets Page Sep Sitename

Asset Allocation Definition And Meaning Market Business News